If you've been trying to trade fair value gaps and your results feel random, it's usually not because FVGs "don't work." It's because you're probably doing what most traders do at the start: you spot a gap, mark it, and assume it's automatically a buy zone or sell zone.

In my experience, not all fair value gaps deserve your attention. The buy and sell pressure does not mean you can set up the trade, especially without verifying or waiting for confirmation. The gaps that matter are the ones tied to real displacement, real structure breaks, and real liquidity behavior.

In this guide, I'll break down what fair value gaps really are and a step-by-step workflow you can use to trade stocks, forex, futures, and crypto.

What Is a Fair Value Gap?

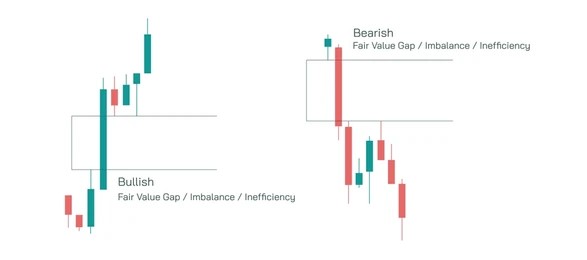

Fair value gap (FVG) is a candlestick pattern where you find three candlesticks forming rapidly when the price moves so aggressively, leaving a void between the wicks of the candles one and three.

You'll typically see it like this: a big displacement candle in the middle, Candle 1 and Candle 3 wicks don't overlap. The "space" between them is the FVG zone. That empty zone exists because the market moved too fast and didn't take the time to trade fairly at those prices.

This quick movement usually creates a price imbalance driven by buy or sell pressure in the market. One side gets aggressive (buyers or sellers), causing the chart to show a "void" of weak participation.

FVG is not a clue for automatic buy-and-sell; every indicator is not an opportunity for a high-probability setup. You have to study it and ensure the gap is not just noise and will not lead to losses.

What Causes Fair Value Gaps?

Fair value gaps form when the market experiences a sudden imbalance; one side (buyers or sellers) becomes so aggressive that the other side can't keep up. Here are the most common triggers of this gap:

- High-impact news and catalysts: Earnings surprises, guidance updates, mergers, downgrades/upgrades, CPI/FOMC, geopolitical headlines. All these can trigger a fast repricing that creates displacement candles and FVGs.

- Large institutional orders: When big money enters (or exits) aggressively, it can overwhelm the order book, causing the price to "jump" through levels rather than trade smoothly through them.

- Liquidity events around key sessions: FVGs often form during the London open, New York open, Power hour/close. That's when liquidity is high, and moves can be decisive.

- Thin liquidity conditions: Price gaps often appear during periods of reduced market liquidity, especially around the opening or closing of a trading session. At these times, fewer active participants are present, so even modest buying or selling pressure can push prices sharply higher or lower.

- Weekend Gaps: Gaps can also occur over the weekend, between Friday's close and Monday's open. News releases, economic developments, or geopolitical events that happen while markets are closed are often reflected all at once when trading resumes.

How to Identify a Fair Value Gap

A valid Fair Value Gap (FVG) forms from a specific three-candle sequence that highlights an imbalance caused by strong price movement. The key is learning to separate meaningful displacement from ordinary market noise.

To avoid over-marking the chart, note that not every three-candle imbalance is tradable. High-quality Fair Value Gaps are typically created by strong displacement, aligned with a break in market structure, and found at key moments (news, session opens, trend continuation). Here is how to identify the fair value gap:

- Look for strong price displacement: Start by identifying a candle with a noticeably large body compared to the candles immediately before and after it. This candle represents aggressive buying or selling and is the foundation of the gap.

- Check the surrounding candles: Examine the candle directly before and the candle directly after the large displacement candle. These two candles are used to define the gap.

- Confirm wick overlap: If the wick of the first candle does not overlap with the wick of the third candle, a price imbalance exists. That non-overlapping space is the Fair Value Gap.

- Mark the imbalance zone: Draw a box around the empty price area between the two wicks and extend it forward on the chart. This highlighted zone represents the FVG and a potential area of interest for future price interaction.

Bullish Fair Value Gap (Gap Below Price)

A bullish FVG forms after strong upward movement.

- The high of the first candle is below the low of the third candle

- No overlap exists between their wicks

- The gap sits below the current price

This zone often acts as a support or retracement area. If price pulls back into the gap, buyers may step in again. If the price moves decisively below the gap, the setup is considered invalid.

Bearish Fair Value Gap (Gap Above Price)

A bearish FVG appears after a strong downward movement.

- The low of the first candle is above the high of the third candle

- There is no wick overlap

- The gap forms above the current price

This area frequently behaves as resistance. When price retraces into the zone, selling pressure may return. If price breaks cleanly above the gap, the FVG is no longer valid.

Read More: What Timeframe Do Day Traders Use? Best Trading Timeframes 2026

How to Trade Fair Value Gaps the Right Way

1. Define the Market Trend

Before using Fair Value Gaps, you need clarity on market direction. Defining the trend helps you determine whether you should be looking for buying or selling opportunities within the gap, or if it's just noise.

Now, if price is consistently forming higher highs and higher lows, the market is trending upward. In this case, your focus should be on long (buy) setups. But if price is creating lower highs and lower lows, the market is trending downward, and short (sell) setups make more sense.

Use the 4-hour, daily, or weekly timeframe for confirmation. A clearly defined trend gives your FVG trades structure and direction.

2. Mark Supply and Demand Zones

Once the trend is established, the next step is identifying the supply and demand zones or order blocks.

In an uptrend, prioritize demand zones, where buying pressure previously pushed the price higher. In a downtrend, focus on supply zones, where strong selling activity caused the price to drop. These zones represent areas where price is more likely to react again.

Your goal is not to predict every move, but to highlight locations on the chart where meaningful reactions are statistically more likely.

3. Use Fair Value Gaps for Trade Entry

Fair Value Gaps become most effective when they align with the trend and a key supply or demand zone, as this alignment creates confluence. For example, in a bearish trend, prices may leave behind a bearish Fair Value Gap during a strong sell-off. If FVG sits near a supply zone or order block, the overlap strengthens the setup.

When price retraces into the FVG area and shows rejection, it can present a high-probability short entry.

The logic behind this is that the market often revisits inefficient price areas before continuing in the original direction. When an FVG and a higher-timeframe zone overlap, the likelihood of a reaction increases.

4. Set Your Stop Loss and Take Profit

Risk management is non-negotiable when trading Fair Value Gaps. If you're entering from a supply zone, place your stop loss above the zone, where the setup becomes invalid. If you're entering from a demand zone, your stop loss should sit below the zone.

For profit targets, many traders aim for the next demand in a short trade or the next supply in a long trade, or a predefined risk-to-reward ratio, such as 1:2 or 1:3.

On lower timeframes, price can move quickly and offer larger reward multiples, but false signals are more common. Higher timeframes typically provide cleaner, more respected levels, though the reward may be smaller relative to risk.

Conclusion

Fair value gaps are powerful in revealing where prices moved too fast and left an imbalance behind.

The traders who win with FVGs don't mark every gap. They wait for the gaps that form from real displacement, in the right location, with the right market context, then they execute with disciplined risk.

Stop taking random gaps and start taking higher-quality setups that actually make sense and guarantee you profitability in your trades.

Related Read: How to Master the Gap and Go Strategy for Day Trading

Frequently Asked Questions

What causes fair value gaps?

Fair value gaps form when aggressive buying or selling creates rapid displacement. Common triggers include news catalysts, institutional orders, session opens, and breakouts from consolidation.

Do fair value gaps always get filled?

No. Many do, but not all. Some get partially filled, some never return, and some slice through. Use structure and trend context to avoid assuming every gap must be filled.

What timeframe is best for trading FVGs?

For most day traders: 15m and 5m for setups, 1H/4H for context. The lower the timeframe, the more noise you'll see.

What makes a fair value gap invalid?

If price cleanly trades through the zone and breaks the structure that supported your idea, the gap loses its edge for that setup. A fully mitigated gap is also a lower probability.

Are FVGs the same as normal gaps?

No. Normal gaps (like stock earnings gaps) often come from overnight repricing. FVGs are a 3-candle imbalance pattern that shows thin auctioning during displacement.

Can I trade FVGs with indicators?

Yes, but indicators only draw boxes. They don't filter for trend, BOS/CHoCH, premium/discount, or freshness. You still need context for high-probability trades.

trading.jpg)

Follow Us On Social Media