Every Trader Needs to understand the average true range formula, a technical indicator used to measure market volatility. Statistics show that most traders lose money not because they pick bad trade ideas, but because their stop losses are too tight or their entries don't match the market's volatility. Average True Range (ATR) fixes that problem.

ATR isn't a trend indicator. It doesn't tell you where the price is going. Instead, it shows you how far price can realistically move, helping you avoid getting stopped out by normal market noise, especially during volatile sessions.

Whether you're a day trader or swing trader, ATR is one of the simplest and most effective volatility tools you can add to your system.

What Is the Average True Range (ATR)?

The Average True Range (ATR) is a technical indicator created by J. Welles Wilder to measure market volatility. The way it works is to measure market volatility by breaking down the entire range of an asset price for a set period (usually 14days). Traders can use short periods of less than 14 days to generate more trading signals; longer periods usually generate fewer trading signals.

The Average True Range (ATR) is a versatile indicator that provides key insights into market activity, including:

- Typical Price Movement: Quantifies the average distance price travels within a defined period.

- Volatility Assessment: Indicates whether market volatility is increasing (high ATR) or decreasing/consolidating (low ATR).

- Anticipating Explosive Moves: Signals when conditions are right to expect a sharp change in price.

- Optimal Stop Placement: Helps determine secure stop-loss levels to avoid premature exits.

The ATR is applicable across various markets, including stocks, crypto, forex, futures, indices, and commodities.

How to Calculate the ATR

To find an asset's true range value:

True Range (TR): First, calculate the True Range for each period (usually a day). The true price range of the asset is obtained by subtracting the high from its low.

TR = Maximum of:

- Current High - Current Low

- Current High - Previous Close

- Current Low - Previous Close

Average True Range (ATR): The second step is to calculate the average of TR over a specified period (usually 14 periods).

ATR = (Previous ATR × (n-1) + Current TR) / n

n = number of periods (e.g., 14)

Example:

Given data:

- High: 120, 125, 130, 128, 135

- Low: 115, 120, 122, 125, 128

- Close: 118, 123, 127, 126, 132

Calculate True Range (TR) for each day:

- Day 1: TR = Max(120-115, |120-118|, |115-118|) = Max(5, 2, 3) = 5

- Day 2: TR = Max(125-120, |125-123|, |120-123|) = Max(5, 2, 3) = 5

- Day 3: TR = Max(130-122, |130-127|, |122-127|) = Max(8, 3, 5) = 8

- Day 4: TR = Max(128-125, |128-126|, |125-126|) = Max(3, 2, 1) = 3

- Day 5: TR = Max(135-128, |135-132|, |128-132|) = Max(7, 3, 4) = 7

TR values = 5, 5, 8, 3, 7

Calculate 5-day ATR:

ATR = (5 + 5 + 8 + 3 + 7) / 5 = 28 / 5 = 5.6

5-day ATR = 5.6

This data will be compared to other ATR values to determine volatility.

- A High ATR signifies High Volatility.

- A Low ATR signifies Low Volatility.

- A Moderate ATR signifies Moderate volatility.

Common Lookback Periods:

- 14-day ATR: The standard/default setting.

- 7-day ATR: Used for assessing shorter-term volatility.

How to Use ATR in Trading

Traders use the average true range to determine market volatility and know when to enter and exit a trade. Helping traders accurately measure the daily volatility of an asset in the market. Even though using the ATR indicator does not indicate the price direction, but used primarily to measure volatility caused by gaps and limit up or down moves.

ATR For Exit Strategy

The Average True Range (ATR) is frequently employed as an exit strategy, independent of the initial entry method. A well-known technique, developed by Chuck LeBeau, is the "chandelier exit." This method sets a trailing stop beneath the highest high the stock has achieved since the trade began.

This is also an effective tool for setting stop-loss orders, especially in volatile markets where fixed stops are often triggered prematurely by normal price fluctuations. The distance for a stop level is calculated by multiplying the ATR by a chosen multiple.

The general ATR stop-loss formula is:

Stop Loss = Entry Price ± (ATR × Multiplier)

A multiplier of 1× ATR provides a tight stop, 1.5× ATR is considered moderate, and 2× ATR is safer.

This method works because it strategically places your stop-loss order outside the typical range of market noise, preventing premature exit.

Using ATR for Take-Profit Targets

The Average True Range (ATR) is a useful tool for estimating potential price movement.

To use ATR for setting realistic targets:

- If the ATR for a forex pair is 20 pips, a realistic price target would be in the range of 20 to 40 pips.

- If the ATR for a stock is $2, a realistic price target would be between $2 and $4.

This method helps in preventing the setting of unrealistic expectations.

ATR for Position Sizing

The Average True Range (ATR) is a key indicator for risk management: a high ATR signifies high volatility, which suggests a smaller position size is appropriate, while a low ATR indicates stable conditions, allowing for a larger position. Implementing this method provides an automated approach to risk management.

ATR for Breakout Confirmation

The Average True Range (ATR) is an important indicator for spotting potential market movements; an increase in ATR, particularly spikes before big moves, suggests that institutional accumulation is taking place. For a potential breakout, a rising ATR indicates a higher likelihood of success, while a falling ATR suggests the breakout may fail. Furthermore, an "ATR explosion" following a period of consolidation often signals the start of a high-probability trend. This framework is especially effective when day trading assets like cryptocurrencies, futures, and stocks.

ATR as a Market Filter

When utilizing Average True Range (ATR), you should avoid trading when ATR is extremely low, as this indicates a lack of market movement (a "dead market"). Conversely, you should trade when ATR is expanding, as this suggests good liquidity and active price movement.

Learn More: Average True Range Indicator Explained Simply In 3 Minutes

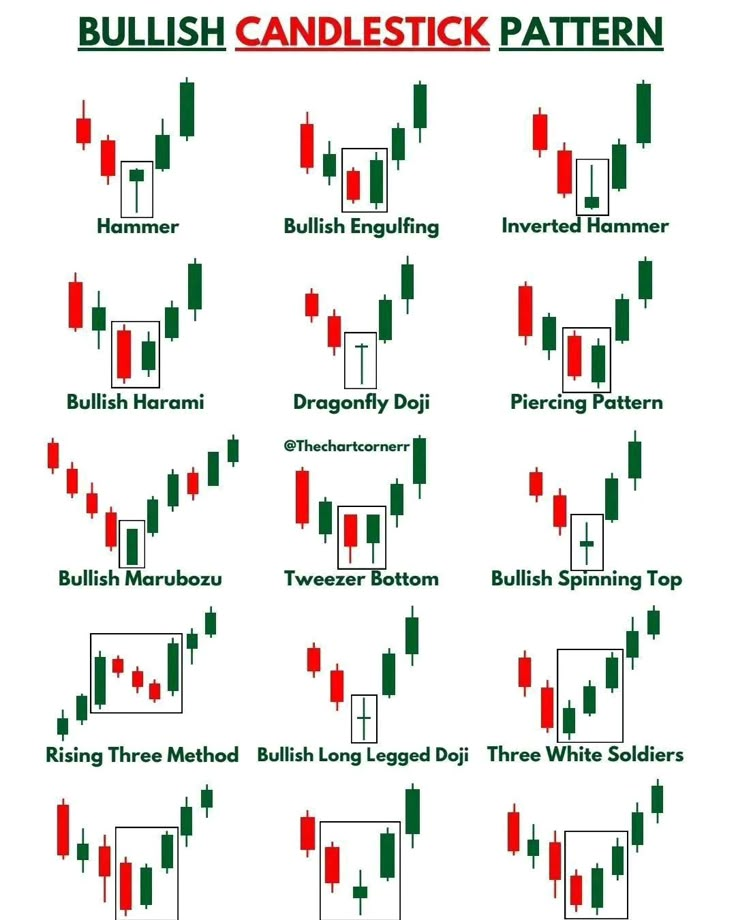

How ATR Relates to Candlestick Movement

The Average True Range (ATR) is fundamentally linked to candlestick size, as it measures the true range of each candle. Understanding this relationship is crucial for traders.

Increased ATR signifies higher volatility, resulting in:

- Larger candlestick bodies.

- Longer candlestick wicks.

- More frequent impulsive price movements.

- Increased reliability of breakouts.

- Higher market momentum.

The expansion discussed is often an indication of significant news events, the continuation of a trend, volatility clustering, liquidity sweeps, or heightened institutional trading activity.

Decreased ATR indicates lower volatility, leading to:

- Smaller candlestick bodies.

- Shorter candlestick wicks.

- A higher probability of breakout failures.

- Prices are becoming confined to narrow trading ranges.

- The market is entering a phase of consolidation.

To summarize the relationship:

- When the Average True Range (ATR) increases (expands), the size of the candlesticks also increases (expands).

- Conversely, when the ATR decreases (contracts), the size of the candlesticks also decreases (contracts).

This direct correlation allows ATR to serve as a predictive tool, helping traders anticipate potentially large moves based on observed candlestick behavior.

Read More: Candlestick Day Trading Patterns: How to Read and Trade Like a Pro

Limitations of ATR

ATR, though simple, has a few limitations.

First, it is a highly subjective measure and open to interpretation. It lacks the capacity to tell you if a trend is about to reverse or not. Seasoned traders compare ATR readings against earlier readings to get a feel of a trend's strength or weakness.

Another limitation is that it only measures market volatility but is not certain about the direction of an asset's price. This leads to mixed signals, especially when one needs to determine if the market is pivoting or trends are at a turning point.

Because of these limitations, Average true range is used in conjunction with other indicators and tools to enter and exit trades or decide whether to purchase an asset.

Common Mistakes Traders Make With ATR

Here are some common mistakes to avoid when using ATR for trading financial assets:

- Using ATR alone without a market structure

- Setting ATR stops too tight (1× ATR on volatile assets)

- Ignoring trend direction

- Forgetting that ATR measures volatility, not trend

- Using the same ATR setting in all markets

- Trading during extremely low ATR periods

ATR is a tool, not a system. It should be paired with other technical tools, price action, structure, and liquidity.

Conclusion

The Average True Range (ATR) is an essential, yet straightforward, indicator for measuring volatility in trading. It serves multiple crucial functions, including helping traders place stop losses that are less likely to be prematurely triggered, identify realistic profit targets, avoid entering into low-volatility traps, recognize conditions favorable for a breakout, and size positions correctly.

Furthermore, it aids in understanding volatility by observing candlestick behavior. Regardless of the market. Whether you are trading futures, crypto, forex, or stocks, ATR is a mandatory tool for any trader's chart.

Read More: How to Spot Trending Stocks: Proven Techniques for Successful Day Traders

Frequently Asked Questions

What is the best ATR setting for day trading?

The default ATR setting is 14, but day traders often use a 7-period ATR for faster reactions to volatility. A 7-day ATR means more signals and tighter stops. A 14-day ATR results in smoother, more reliable volatility readings. The best setting depends on market type and your strategy.

Does ATR work in all markets?

Yes. ATR works exceptionally well across forex, crypto, stocks, futures, and even the commodities market. Any market that produces candlesticks can use ATR because it measures true range.

Can ATR predict trend direction?

No. ATR does not predict direction; it only measures volatility. A rising ATR equals increasing volatility, while a falling ATR signifies decreasing volatility. A trader must combine ATR with structure, support/resistance, moving averages, or momentum indicators for more direction.

How does ATR help prevent premature stop-loss hits?

ATR tells you how much the price typically moves. If your stop-loss is smaller than the ATR, you will almost always be stopped out due to noise. When your stop-loss is 1.5× or 2× ATR, it sits outside normal market movement.

What does a rising ATR indicate?

A rising Average True Range (ATR) signifies increasing market volatility, often indicated by expanding candlestick sizes. This suggests a higher probability of strong price impulses, potential institutional activity, and conditions ripe for a breakout. Traders frequently watch for spikes in the ATR as a precursor to major market moves.

Can ATR be used for entries?

The Average True Range (ATR) is not intended as an entry indicator itself, but it serves to refine entries by confirming the expansion of volatility. Its best use cases for entries include breakout trading, trend continuation, and reversal confirmation signaled by volatility spikes.

Is ATR better than Bollinger Bands or RSI?

While Average True Range (ATR) measures volatility, it serves a different purpose than other indicators. For instance, Bollinger Bands also measure volatility, but they additionally measure deviation from the mean, and the Relative Strength Index (RSI) measures momentum and overbought/oversold conditions. Therefore, these indicators complement each other rather than replace one another.

What does it mean when ATR is extremely low?

An extremely low Average True Range (ATR) often signifies a dead market or a consolidation zone, suggesting low liquidity and a high likelihood of fake breakouts. Consequently, most traders choose to avoid entering the market until the ATR begins to expand again, indicating a return of volatility.

Follow Us On Social Media