Day Trading Simulation Calculator

Simulate your day trading performance by inputting key factors to help determine if you will blow your account. This calculator helps you visualize potential account growth or drawdown over a series of trades.

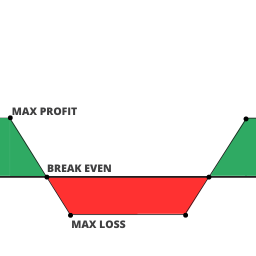

Option Profit Visualization Calculator

Analyze your potential gains or losses on option trades by inputting various market scenarios. This tool helps you assess risk and reward, making it easier to strategize your options trading.

Risk Management Calculators

Determine the optimal amount of capital to allocate to each trade to manage risk effectively. Proper risk management is crucial for long-term trading success and capital preservation.

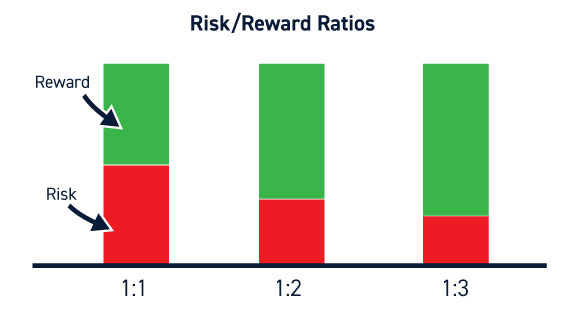

Risk/Reward Ratio Calculator

Calculate and visualize the risk-to-reward ratio for your trades. Evaluate potential profit versus potential loss to make informed trading decisions and ensure favorable risk/reward setups.

CAGR Calculator

Calculate the compound annual growth rate of your investment or portfolio over time. This calculator helps you understand how consistently your investments have grown, enabling better comparison between assets and more informed long-term financial planning.

Position Size Calculator

Use this free Position Size Calculator to determine exactly how many shares, units, lots, or contracts you should trade — based on your account balance, risk percentage, and stop-loss distance.

How To Use

- Day Trading Simulation Calculator:

This calculator helps you simulate day trading performance by inputting your trades, win/loss ratios, position sizing, and other key factors. It allows you to visualize potential account growth or drawdown over a series of trades, enabling you to refine your strategies and improve your overall profitability.

- Option Profit Visualization Calculator:

This calculator allows you to analyze potential profit and loss scenarios for different options strategies. By inputting details such as the type of option (call or put), strike price, action (buy to open or sell to open), price of contract, and number of contracts, you can see a graph of the option profit at different levels, as well as key metrics like max loss, max profit, break-even points, current stock price, and percentage move to break even.

- Risk Management Calculators:

These calculators help you determine the appropriate position size based on your inputs. There are two types:

- Support Based Stop Loss: Intended for use with share positions, this calculator requires inputs such as total account size, max risk tolerance, entry price, target sell price, and support price. It is not suitable for options trades.

- Percent Based Stop Loss: Suitable for both shares and options trades, this calculator requires inputs such as total account size, max risk tolerance, stop loss percentage, entry price per share or per contract, and target profit percentage.

- Risk/Reward Ratio Calculator:

This calculator helps you evaluate the risk-to-reward ratio for your trades. By inputting your entry price, stop loss, and target price, you can visualize whether a trade offers a favorable risk/reward setup. A good rule of thumb is to aim for a minimum 1:2 risk/reward ratio (risking $1 to potentially make $2).

- CAGR Calculator:

This calculator computes the Compound Annual Growth Rate (CAGR) of your investment or portfolio. By entering your initial investment value, final value, and the time period, you can determine the annualized rate of return. This metric is useful for comparing the performance of different investments over time and understanding the consistency of your portfolio growth.

Disclaimer: Trading is inherently risky, and these tools do not constitute advice for any trades or risks the user takes. They are simply tools to be used at your own risk. We assume no liability for losses. Always consult with a financial advisor before making any investment decisions.

Trading 101

Trading involves buying and selling financial instruments such as stocks, bonds, commodities, and currencies with the aim of making a profit. Traders actively participate in the financial markets by executing trades based on market analysis and strategies.

There are several types of trading, including:

- Day Trading: Buying and selling assets within the same trading day.

- Swing Trading: Holding positions for several days to weeks to capture short- to medium-term gains.

- Scalping: Making numerous trades throughout the day to profit from small price changes.

- Position Trading: Holding positions for longer periods, ranging from weeks to months or even years, based on long-term trends.

Day trading involves buying and selling financial instruments within the same trading day. The goal is to capitalize on short-term price movements and make a profit from these trades. Day traders often use leverage and short-term strategies to maximize their returns.

Leverage in trading refers to using borrowed funds to increase the potential return on investment. Traders can open larger positions than their own capital would allow, but this also increases the risk, as losses can exceed the initial investment.

The bid price is the highest price a buyer is willing to pay for a security, while the ask price is the lowest price a seller is willing to accept. The difference between the bid and ask prices is known as the spread, which represents the transaction cost for traders.

A stop-loss order is a type of order placed with a broker to buy or sell once the stock reaches a certain price. It's used to limit an investor's loss on a security position. For example, setting a stop-loss order 10% below the price at which you bought the stock will limit your loss to 10%.

Traders use various tools to assist in their trading decisions, including:

- Trading Platforms: Software for executing trades and accessing market data.

- Charting Tools: Tools for visualizing price movements and identifying patterns.

- News Services: Real-time news feeds to stay updated on market events.

- Economic Calendars: Schedules of economic events that can impact markets.

- Analytical Software: Programs for performing technical and fundamental analysis.

Technical analysis involves analyzing statistical trends from trading activity, such as price movement and volume. Traders use charts and other tools to identify patterns that can suggest future price movements. Key concepts include support and resistance levels, moving averages, and chart patterns.

Fundamental analysis evaluates a security's intrinsic value by examining related economic, financial, and other qualitative and quantitative factors. This approach involves studying financial statements, economic indicators, and industry trends to determine a security's fair value.

Trading signals are indicators or triggers based on specific criteria used by traders to make buy or sell decisions. These signals can be generated by technical analysis, fundamental analysis, or a combination of both. Automated trading systems and signal services often use these signals to execute trades.

A trading strategy is a fixed plan designed to achieve profitable returns by going long or short in markets. It typically includes specific rules for trade entries, exits, and risk management. Successful trading strategies are based on thorough analysis and backtesting.

Risk management is crucial in trading to minimize potential losses. Key strategies include:

- Setting Stop-Loss Orders: Automatically selling a security when it reaches a predetermined price to limit losses.

- Diversifying: Spreading investments across different assets to reduce exposure to any single asset.

- Position Sizing: Determining the size of a trade based on the level of risk you are willing to take.

- Using Leverage Cautiously: Being aware of the risks associated with leverage and not overextending your positions.

- Continuous Education: Staying informed about market conditions and adjusting strategies accordingly.

Emotions like fear and greed can significantly impact trading decisions. Fear can cause traders to sell prematurely or avoid taking necessary risks, while greed can lead to overtrading or holding onto losing positions too long. Successful traders maintain discipline, stick to their trading plan, and manage their emotions effectively.

What Is F.I.R.E.?

The F.I.R.E. movement stands for "Financial Independence, Retire Early." It is a lifestyle and financial strategy that focuses on achieving financial independence as quickly as possible to retire early and gain the freedom to live life on one's own terms. The movement has gained significant popularity over the past decade as more people seek to escape the traditional work-life balance and find greater fulfillment and freedom in their lives.

Why Do People Want to Achieve F.I.R.E.?

People are drawn to the F.I.R.E. movement for various reasons, including the desire for more personal freedom, the ability to pursue passions and hobbies, the chance to travel and experience new cultures, and the opportunity to spend more time with family and friends. The core motivation behind F.I.R.E. is the pursuit of a life that is not dictated by financial constraints or the need to work a traditional 9-to-5 job until the standard retirement age.

Achieving F.I.R.E. typically involves a combination of high savings rates, strategic investments, and careful budgeting to build a substantial financial cushion that can support one's living expenses without the need for a traditional job. This often requires making lifestyle adjustments and sacrifices in the short term to enjoy long-term financial freedom.

Types of F.I.R.E.: Fat Fire and Lean Fire

There are different approaches within the F.I.R.E. movement, primarily categorized as Fat Fire and Lean Fire:

- Fat Fire: Fat Fire refers to achieving financial independence with a higher level of income and spending, allowing for a more comfortable and often luxurious lifestyle. Individuals pursuing Fat Fire aim to accumulate a larger nest egg that can support higher living expenses, including travel, dining out, and other discretionary spending. This approach requires a higher savings rate and often a longer time horizon to reach financial independence.

- Lean Fire: Lean Fire, on the other hand, focuses on achieving financial independence with a more minimalist lifestyle and lower spending. Individuals pursuing Lean Fire prioritize frugality and may live on a tighter budget to reach financial independence sooner. This approach requires a smaller nest egg and emphasizes reducing living expenses to the bare essentials.

What Is Right For Me?

Ultimately, the F.I.R.E. movement is about gaining control over one's financial future and creating the freedom to live life on one's own terms. Whether pursuing Fat Fire or Lean Fire, the principles of high savings, strategic investments, and mindful spending are at the core of achieving financial independence and the ability to retire early. By adopting these principles, individuals can work towards a future where they are no longer bound by financial constraints and can enjoy the freedom to pursue their passions and dreams.

About Us

Your Average Investor is dedicated to providing the resources and education needed for the average investor to achieve exceptional results. Our primary mission is to help you achieve financial independence so that you can enjoy life however you like.

Achieving financial independence starts with developing a solid financial literacy and education by learning about stocks, real estate, cryptocurrency, business, and personal finance. It also means learning how to take advantage of the tax code to keep more of what you earn.

We believe in maximizing your earned income and leveraging it to start building semi-passive and passive streams of income. Whether you're a beginner or an experienced investor, we have the tools and knowledge to help you succeed.

Join us on this journey to financial independence and start creating the life you want today!

Follow Us On Social Media