If you've ever asked yourself, "When is the best time to trade forex?"—you're not alone. Understanding forex market hours can be the difference between successful trades and frustrating losses. In fact, knowing when the forex market opens and closes, and which trading sessions are most active, can help you plan smarter strategies, avoid low-volume times, and take advantage of high-profit opportunities.

Let's break it all down into simple terms.

Why Forex Market Hours Matter

The forex market is unlike the stock market. It doesn't have a single exchange or set trading floor. Instead, it operates across major financial centers worldwide, allowing you to trade 24 hours a day, five days a week. But that doesn't mean every hour is ideal for trading.

That's where forex market hours come in. Knowing the best time to trade, when the forex market opens and closes, and how time zones affect trading hours can significantly impact your success. The forex schedule today could look very different from what it was yesterday, depending on news events, volatility, and overlapping sessions.

How the 24-Hour Forex Market Works

The forex market is open 24 hours a day from Monday morning in Asia (Sunday evening in the U.S.) to Friday evening in New York. But the market isn't equally active all the time. It goes through cycles that reflect the working hours of major financial centers around the globe.

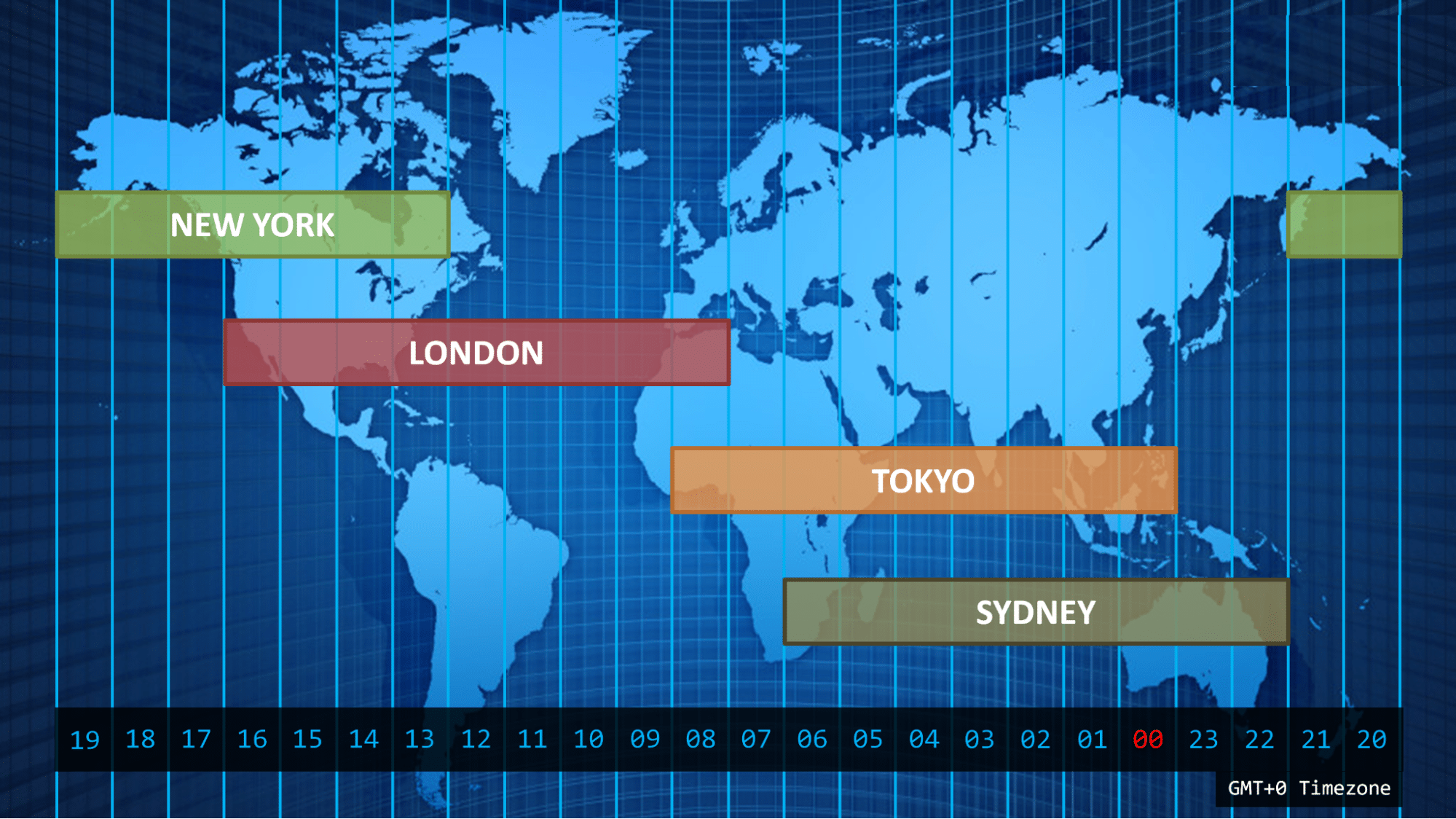

These cycles are called forex trading sessions, and they follow this rough schedule:

- Sydney (Australia) opens first

- Then Tokyo (Asia)

- Followed by London (Europe)

- And finally New York (North America)

Each session overlaps slightly with the next, which creates windows of high trading volume. This 24-hour structure is what makes forex such an appealing market for traders worldwide. Whether you live in New York, London, Sydney, or Nairobi, you have access to the market during your daytime hours.

Major Forex Sessions and Time Zones

Let's take a closer look at each major forex session. Each one plays a unique role in global currency trading and has its own peak hours and characteristics.

Sydney Session (Asia-Pacific Open)

- Open Time: 10 PM GMT (5 PM EST)

- Close Time: 7 AM GMT (2 AM EST)

The Sydney session is the first to open and gets the forex market rolling for the week. While it's generally the least volatile session, it still matters, especially for traders focusing on the AUD (Australian dollar), NZD (New Zealand dollar), and JPY (Japanese yen).

If you live in a region closer to Asia-Pacific, this might be the best time trading is available for you.

Tokyo Session (Asia)

- Open Time: 12 AM GMT (7 PM EST)

- Close Time: 9 AM GMT (4 AM EST)

The Tokyo session is often considered part of the Asian trading hours. It sees more action than Sydney and is known for sharp moves in JPY currency pairs like USD/JPY and EUR/JPY. The Tokyo market overlaps slightly with both Sydney and London, adding to liquidity.

It's a great time to trade if you're into pairs influenced by Asian economies. Traders looking at currency market trading hours in this region find Tokyo particularly useful.

London Session (Europe)

- Open Time: 8 AM GMT (3 AM EST)

- Close Time: 5 PM GMT (12 PM EST)

The London session is arguably the most important in the forex world. Why? Because London is a major financial hub, and a significant chunk of all daily forex transactions happen during this window.

Most volatility and trading volume occur here. When London overlaps with Tokyo or New York, you'll often see sharp price movements and trading opportunities. This session is especially valuable for traders focusing on EUR, GBP, and CHF pairs.

If you want high action, forex market times during London hours are gold.

New York Session (North America)

- Open Time: 1 PM GMT (8 AM EST)

- Close Time: 10 PM GMT (5 PM EST)

The New York session wraps up the global trading day. While it doesn't quite match the London session in volume, it's still incredibly important, especially for USD pairs, since the U.S. dollar is involved in nearly 90% of all trades.

This session is great for short-term traders, news traders, and anyone interested in U.S. economic indicators.

When the forex close time hits on Friday, it's during the New York session.

Forex Session Overlaps: Best Time to Trade

Here's the secret sauce: the most profitable and active forex periods are usually when two sessions overlap.

- Tokyo-London Overlap: 8 AM to 9 AM GMT

- London-New York Overlap: 1 PM to 5 PM GMT

These overlaps represent peak activity. This is when institutional traders, retail traders, and everyone in between flood the market with trades. Spreads narrow, volatility rises, and it becomes much easier to get in and out of positions with minimal slippage.

If you're looking for the best trade time, aim for these overlaps. They're prime-time for scalping, day trading, and executing short-term strategies.

Forex Market Open and Close Times (Quick Reference)

Here's a simplified view of the forex schedule today, based on GMT:

- Sydney: 10 PM - 7 AM

- Tokyo: 12 AM - 9 AM

- London: 8 AM - 5 PM

- New York: 1 PM - 10 PM

Depending on your time zone, these trading hours may shift. It's always wise to use a live market hours tool or forex time converter to get accurate market forex hours based on your local time.

Best Times to Trade Forex for Profit

Not all hours are created equal. Just because the market is open doesn't mean it's a good time to trade.

The best forex trading market hours are:

- When sessions overlap (especially London-New York)

- During major economic announcements (but only if you know how to trade news)

- When your strategy aligns with market conditions (e.g., volatility, trend strength)

Avoid trading during "dead zones"—periods with low volume and little price movement. That's usually the time between New York close and Sydney open.

Smart traders match their forex open time with times of high volume. That's how they maximize profits and minimize frustration.

Worst Times to Trade (Low Liquidity Periods)

Some hours are notoriously slow and unprofitable. These include:

- Late Friday (before close): Most traders are closing positions, not opening them.

- Sunday afternoon (just after Sydney opens): Liquidity is still building up.

- Major holidays: Especially Christmas, New Year's Day, and U.S. Thanksgiving.

During these times, the market may still be technically open, but you're more likely to see erratic behavior or tight, choppy ranges—not ideal for most strategies.

Forex Trading Tools to Help You Track Market Hours

To stay on top of market hours and session activity, use helpful tools like:

- Forex session clocks

- Market open/close widgets

- Forex trading calendars

- The Day Trading Profit Calculator on this site

These tools let you keep track of forex schedule today, upcoming news events, and when the next big opportunity is about to happen.

Final Thoughts: Align Your Strategy with Forex Market Hours

If you're serious about trading forex, understanding market hours isn't optional—it's essential.

The key to success isn't just knowing the forex market open hours, but recognizing which times give you the best shot at making profitable trades. Focus on trading during overlapping sessions, match your strategy to the right times of day, and avoid low-liquidity hours.

Whether you're a night owl in Asia or a morning trader in Europe, there's always a piece of the forex market open somewhere. Master the clock, and you'll master the trade.

So, what's your plan for today's forex schedule? Know your session, pick your moment, and trade smart.

FAQs About Forex Market Hours

Can I trade Forex on weekends?

No, the Forex market is closed to retail traders on weekends. Trading typically halts at 5:00 PM EST on Friday and resumes at 5:00 PM EST on Sunday. However, some brokers may offer limited access to certain instruments during the weekend, but liquidity is generally low, and spreads can be wider.

Do Forex market hours change during Daylight Saving Time (DST)?

Yes, Forex market hours can shift due to DST changes in different countries. For instance, when the U.S. observes DST, the New York session may open and close an hour earlier in GMT terms. It's essential to adjust your trading schedule accordingly to account for these changes.

Is it advisable to trade during major news releases?

Trading during major economic news releases can lead to increased volatility and potential trading opportunities. However, it also carries higher risk due to sudden price movements and potential slippage. Traders should use caution and have a solid risk management strategy in place if choosing to trade during these times.

Are there specific days of the week that are better for trading?

Yes, trading activity and volatility can vary throughout the week. Typically, Tuesdays through Thursdays see more consistent volatility, while Mondays can be slower as the market digests weekend news, and Fridays may see reduced activity as traders close positions ahead of the weekend.

Can I trade any currency pair at any time?

While you can technically trade any currency pair at any time during market hours, liquidity and volatility vary. Major currency pairs like EUR/USD, GBP/USD, and USD/JPY have the highest liquidity during their respective sessions. Trading these pairs during their active sessions can result in tighter spreads and better execution.

What happens if I hold a position over the weekend?

Holding positions over the weekend exposes you to potential market gaps between Friday's close and Sunday's open, which can lead to significant price changes. It's crucial to consider this risk and use appropriate risk management strategies, such as stop-loss orders, if you plan to hold positions over the weekend.

How do I adjust my trading schedule for different time zones?

To align your trading schedule with Forex market hours, convert the session times to your local time zone. Many online tools and Forex market hour converters are available to help you determine the best times to trade based on your location.

Is it better to trade during session overlaps?

Yes, session overlaps, such as the London/New York overlap, typically offer higher liquidity and volatility, providing more trading opportunities. These periods are often considered optimal for trading due to increased market activity.

Is the forex market open 24 hours a day?

Yes, from Monday morning in Sydney to Friday evening in New York. However, not all hours are active or profitable.

What time does the forex market open on Sunday?

The market typically opens at 10 PM GMT (5 PM EST) on Sunday with the Sydney session.

When does the forex market close on Friday?

The market closes at 10 PM GMT (5 PM EST) during the New York session.

What's the most active forex session?

The London session, especially during its overlap with New York.

Want to make better, more profitable trading decisions? Use the Day Trading Profit Calculator to track your trades and improve your results.

So if you're ready to take your trading to the next level, give The STRAT a try—and don't forget to bring your profit calculator along for the ride.

Follow Us On Social Media